Basic information

What is open banking?

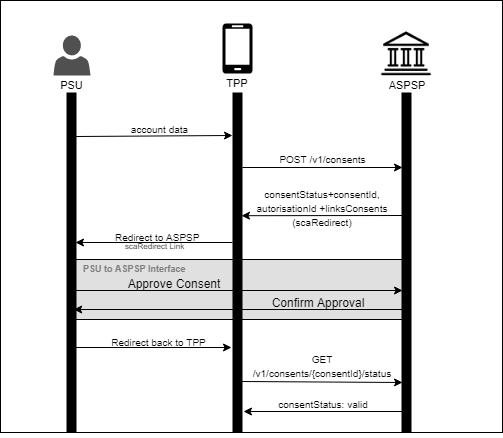

Open banking is the secure process of sharing financial account data between banks and third-party providers, as well as initiating payments. It promotes innovation, competition, and efficiency—making financial services quicker, simpler, and more secure.

What is PSD2?

The Second Payment Services Directive (PSD2) provides the legal foundation for the development of open banking and a better-integrated internal market for electronic payments within the European Union. PSD2 requires banks to allow third-party providers to access information from payment accounts, with the goal of establishing harmonized rules for the provision of payment services across the EU and ensuring a high level of consumer protection.

Who are PSD2 APIs for?

PSD2 APIs are primarily designed for Third-Party Providers (TPPs), which fall into two main categories:

Account Information Service Providers (AISPs): These providers can access customer account data (with consent) to offer services like budgeting tools, financial dashboards, and credit checks.

Payment Initiation Service Providers (PISPs): These providers can initiate payments directly from a customer's bank account, offering alternatives to traditional card-based payments (e.g., online checkout solutions).

TPPs are licensed and regulated entities, possessing the specific eIDAS certificate, that can access banking data or initiate payments on behalf of users, provided the user gives explicit consent. You can apply for an AISP/PISP license at your national financial authority. Once you have a valid license, you need to obtain valid TPP certificates for production access.

Other stakeholders who use or benefit from PSD2 APIs:

ASPSPs (Account Servicing Payment Service Providers):These are mainly banks or financial institutions that hold and manage user accounts. Under PSD2, they are required to expose certain functionalities and data via APIs to authorized TPPs, when the user consents.

End Users (Consumers and Businesses):These are not the direct users of PSD2 APIs, but benefit from greater control over financial data, innovative financial services and potentially lower fees due to increased competition.

What services are we offering?

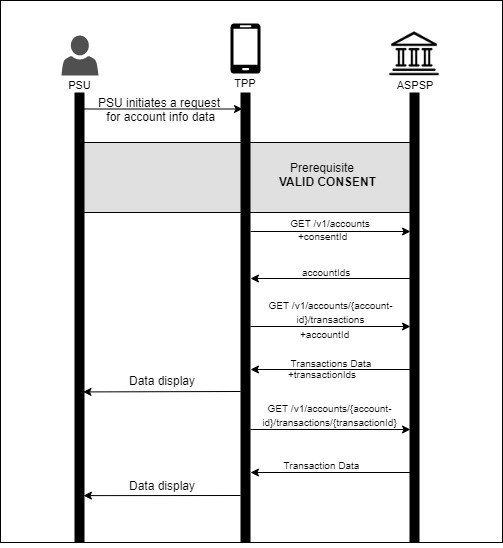

Account Information Services (AIS) give consumers and businesses an overview of their financial situation by consolidating information from the different payment accounts they hold with one or more payment service providers. The Account Information Service offers the following features:

A list of available accounts or card accounts

Account details for a specific account or card account, or for all accessible accounts or card accounts related to a granted consent

Transaction reports for a given account or card account, including balances where applicable

Details of specific transaction

Balances of a given account or card account

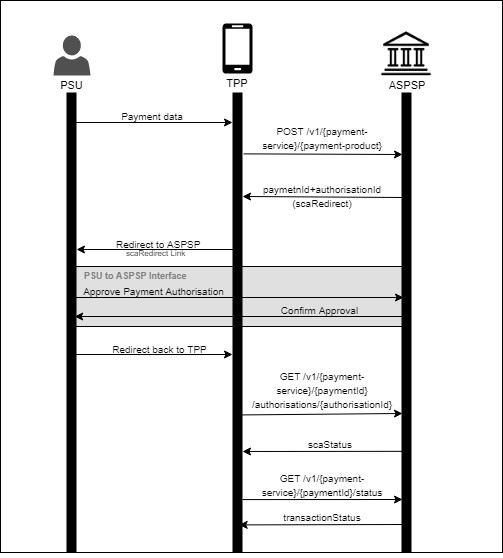

Payment Initiation Services (PIS) help consumers make online payments and notify the merchant immediately when a payment is initiated, allowing for the prompt dispatch of goods or instant access to purchased online services. The Payment Initiation Service offers the following features:

Initiation and update of payment request

Status information of a payment

Payment Instrument Issuing Service (PIIS) checks whether a specific amount is available at the time of the request on an account linked to a given card issuer (TPP)/card number, or addressed by IBAN and TPP, respectively.

Glossary

| AISP | Account Information Service provider |

| PISP | Payment initiation service provider |

| PIISP | Payment Instrument Issuer Service Providers |

| PSU | Payment service user |

| TPP | Third-party provider |

| ASPSP | Account Servicing Payment Service Providers |

| SCA | Strong Customer Authentication |